Tax Invoice In Malay / Tax Invoice Templates | Quickly Create Free Tax Invoices - Sst (sales and service tax) shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in malaysia by a taxable person.

Written on: May 21, 2021

Title : Tax Invoice In Malay / Tax Invoice Templates | Quickly Create Free Tax Invoices - Sst (sales and service tax) shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in malaysia by a taxable person.

link : Tax Invoice In Malay / Tax Invoice Templates | Quickly Create Free Tax Invoices - Sst (sales and service tax) shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in malaysia by a taxable person.

Tax Invoice In Malay / Tax Invoice Templates | Quickly Create Free Tax Invoices - Sst (sales and service tax) shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in malaysia by a taxable person.

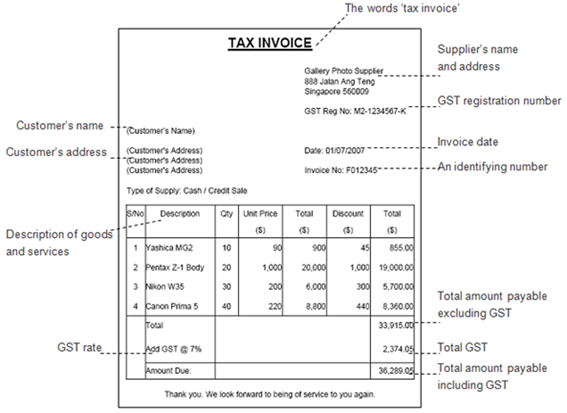

Tax Invoice In Malay / Tax Invoice Templates | Quickly Create Free Tax Invoices - Sst (sales and service tax) shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in malaysia by a taxable person.. A company is deemed to be tax resident in malaysia in a financial year if, at any time during the basis year, the management and control of its. The fpx (financial process exchange) gateway allows you to pay your income tax online in malaysia. In malaysia, both individuals and entities who are registered taxpayers with the inland revenue board of malaysia (irbm) are assigned with a tax identification number (tin) known as nombor cukai pendapatan or income tax number (itn). There are various taxes that you will need to bear in mind if you are planning on relocating to malaysia, and wish to draw up a budget and have a better idea of your net salary. I need help in tax invoice format such as the following

Malaysia is a very tax friendly country. Look through examples of tax invoice translation in sentences, listen to pronunciation and learn grammar. All companies who have registered with royal customs malaysia failure to issue correct tax invoice may result in fine & penalty of not more than rm300,000 or imprisonment of not more. Tax incentives can be granted through income exemption or by way of allowances. It serves as proof of payment for the supply of goods and service and is essential evidence to support to input tax credit claim.

Ticket purchase date up to:

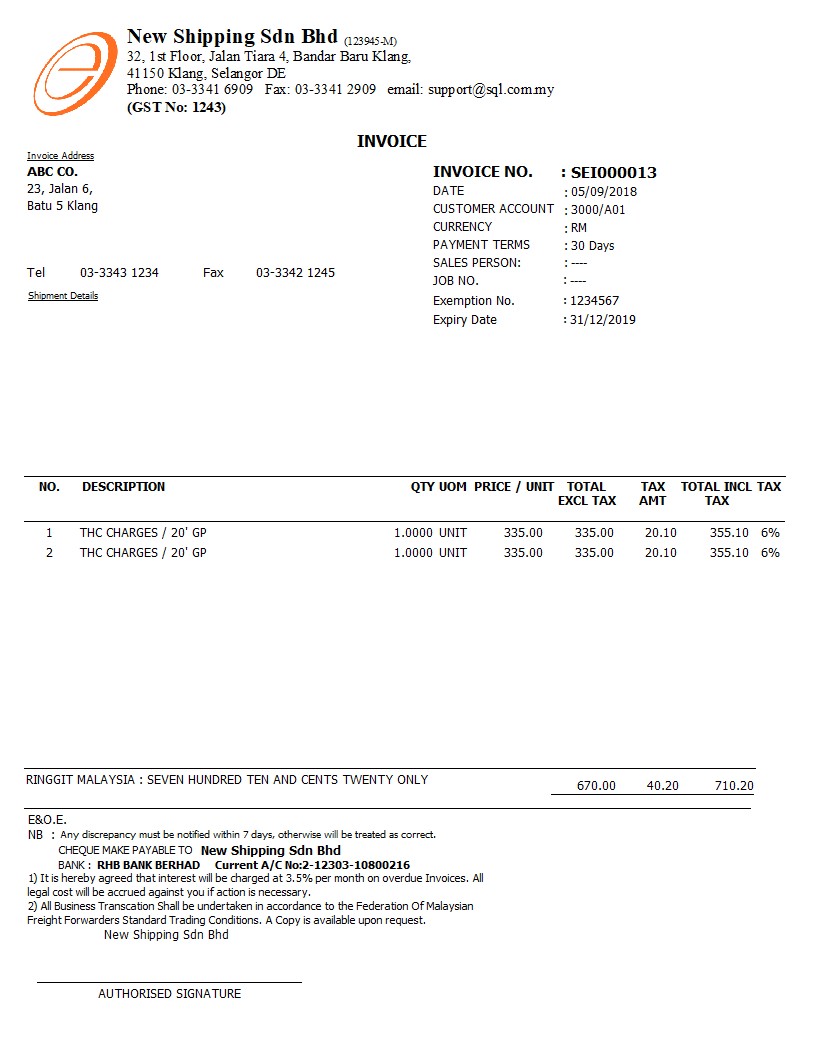

Search, download, print and save invoices in a variety of formats. Malaysia is a very tax friendly country. In order to comply with tax laws, you should include the following information on your invoices to customers in malaysia All companies who have registered with royal customs malaysia failure to issue correct tax invoice may result in fine & penalty of not more than rm300,000 or imprisonment of not more. Malaysia goods and services tax (gst). Ticket purchase date up to: Tax incentives can be granted through income exemption or by way of allowances. Personal income tax rates in malaysia. Good evening, i need help in tax invoice format such as the following: How to pay income tax in malaysia. Get your invoices electronically with fedex billing online in malaysia. The basic layout of the sheet is similar to the standard bill format shipped with invoice manager, but the static text labels are translated using an online tool. 6% sales service tax (sst) for all fares, fees, ancillaries and airport and other taxes.

This invoice differs from the sample full tax invoice in that it omits the invoice title, and the. Effective 1st september 2018, malaysia airlines' domestic routes will be subject to the from 1st september 2018, malaysia airlines will not be issuing a tax invoice to passengers as no input tax credits may be claimed. Now that you're up to speed on whether you're eligible for taxes and how the tax rates work, let's get down to the business of actually filing your yeap, the original invoice should show the full price of your laptop. Malaysia is a very tax friendly country. International tax agreements and tax information sources.

Tax invoice is standard format invoice required under gst system.

More and more companies have been recognizing the. In malaysia, a tax invoice is the standard invoice format required under the gst system. Personal income tax rates in malaysia. If you hire a local citizen they are already residents, and some expats on assignment may also meet the resident criteria if. Look through examples of tax invoice translation in sentences, listen to pronunciation and learn grammar. A company is deemed to be tax resident in malaysia in a financial year if, at any time during the basis year, the management and control of its. I need help in tax invoice format such as the following Cukai, invois, handphone, paper size, baki lejar, invoisname, tanah cukai. Detailed description of corporate tax credits and incentives in malaysia. This malaysia tax invoice template translates all the text inside the printable form into malay. In malaysia, both individuals and entities who are registered taxpayers with the inland revenue board of malaysia (irbm) are assigned with a tax identification number (tin) known as nombor cukai pendapatan or income tax number (itn). Contextual translation of tax invoice into malay. Now that you're up to speed on whether you're eligible for taxes and how the tax rates work, let's get down to the business of actually filing your yeap, the original invoice should show the full price of your laptop.

One week after the flight departure. If you hire a local citizen they are already residents, and some expats on assignment may also meet the resident criteria if. Simplified tax invoice under certain circumstances, some registered persons may find it difficult to issue a full tax invoice to their customers. Tax system for corporates and individualsin malaysia. (a) an individual is a tax resident in malaysia if present in malaysia on basis year for 182 days or more in a calendar year.

In malaysia, both individuals and entities who are registered taxpayers with the inland revenue board of malaysia (irbm) are assigned with a tax identification number (tin) known as nombor cukai pendapatan or income tax number (itn).

Contextual translation of tax invoice into malay. The basic layout of the sheet is similar to the standard bill format shipped with invoice manager, but the static text labels are translated using an online tool. This malaysia tax invoice template translates all the text inside the printable form into malay. Detailed description of corporate tax credits and incentives in malaysia. This invoice differs from the sample full tax invoice in that it omits the invoice title, and the. Tax amount (sst, gst etc.) and discounts are important details to include as it gives your customers a clear view of additional charges. More and more companies have been recognizing the. Personal income tax rates in malaysia. Effective 1st september 2018, malaysia airlines' domestic routes will be subject to the from 1st september 2018, malaysia airlines will not be issuing a tax invoice to passengers as no input tax credits may be claimed. The total amount payable including the total tax. Now that you're up to speed on whether you're eligible for taxes and how the tax rates work, let's get down to the business of actually filing your yeap, the original invoice should show the full price of your laptop. It is crucial to issue correct and proper tax invoice to the customer for. One week after the flight departure.

That's the article Tax Invoice In Malay / Tax Invoice Templates | Quickly Create Free Tax Invoices - Sst (sales and service tax) shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in malaysia by a taxable person.

You are now reading the article Tax Invoice In Malay / Tax Invoice Templates | Quickly Create Free Tax Invoices - Sst (sales and service tax) shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in malaysia by a taxable person. with link address https://dinaressgurus.blogspot.com/2021/05/tax-invoice-in-malay-tax-invoice.html